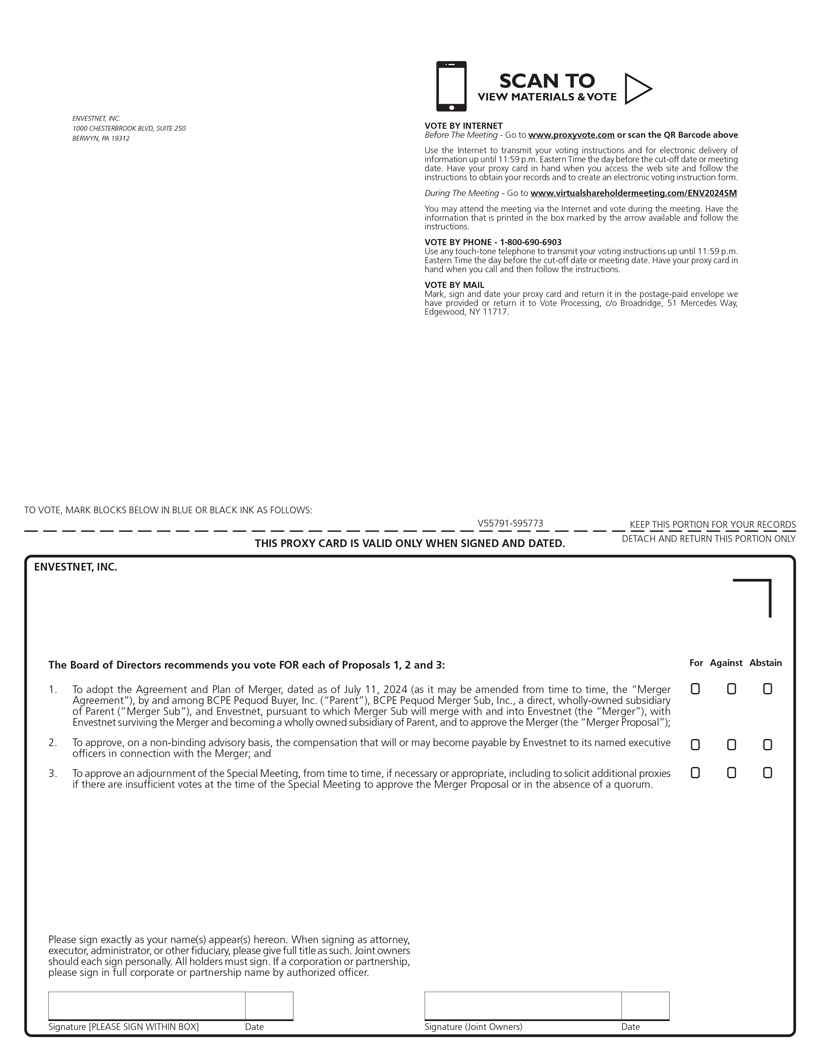

[PRELIMINARY COPY—SUBJECT TO COMPLETION] ENVESTNET, INC. 1000 CHESTERBROOK BLVD, SUITE 250 BERWYN, PA 19312 SCAN TO VIEW MATERIALS & VOTE w VOTE BY INTERNET Before The Meeting—Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting—Go to www.virtualshareholdermeeting.com/ENV2024SM You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE—1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: V55791-S95773 KEEP THIS PORTION FOR YOUR RECORDS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY ENVESTNET, INC. The Board of Directors recommends you vote FOR each of Proposals 1, 2 and 3: For Against Abstain 1. To adopt the Agreement and Plan of Merger, dated as of July 11, 2024 (as it may be amended from time to time, the “Merger ! ! ! Agreement”), by and among BCPE Pequod Buyer, Inc. (“Parent”), BCPE Pequod Merger Sub, Inc., a direct, wholly-owned subsidiary of Parent (“Merger Sub”), and Envestnet, pursuant to which Merger Sub will merge with and into Envestnet (the “Merger”), with Envestnet surviving the Merger and becoming a wholly owned subsidiary of Parent, and to approve the Merger (the “Merger Proposal”); 2. To approve, on a non-binding advisory basis, the compensation that will or may become payable by Envestnet to its named executive ! ! ! officers in connection with the Merger; and 3. To approve an adjournment of the Special Meeting, from time to time, if necessary or appropriate, including to solicit additional proxies ! ! ! if there are insufficient votes at the time of the Special Meeting to approve the Merger Proposal or in the absence of a quorum. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date