UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x | |

Filed by a Party other than the Registrant o | |

Check the appropriate box: | |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a‑12 |

Envestnet, Inc. | |||||

(Name of Registrant as Specified In Its Charter) | |||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||||

Payment of Filing Fee (Check the appropriate box): | |||||

x | No fee required. | ||||

o | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. | ||||

(1 | ) | Title of each class of securities to which transaction applies: | |||

(2 | ) | Aggregate number of securities to which transaction applies: | |||

(3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

(4 | ) | Proposed maximum aggregate value of transaction: | |||

(5 | ) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | ||||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1 | ) | Amount Previously Paid: | |||

(2 | ) | Form, Schedule or Registration Statement No.: | |||

(3 | ) | Filing Party: | |||

(4 | ) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | |||||

April 8, 2020

Chicago, Illinois

Dear Fellow Shareholder:

It is with great pleasure that we invite you to our 2020 Annual Meeting of Shareholders. The meeting will be held on May 13, 2020 at 10:00 a.m. Central Time. As part of our precautions regarding the COVID-19 pandemic, this year’s Annual Meeting will be a virtual-only meeting. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting https://web.lumiagm.com/241143720.

Our formal agenda for this year’s meeting is to vote on the election of directors; to vote, on an advisory basis, on 2019 executive compensation; and to ratify the selection of our independent registered public accounting firm for 2020. In addition, we will report to you on the highlights of 2019 and discuss the outlook for our business in 2020.

Whether or not you plan to attend the virtual Annual Meeting, your vote on these matters is important to us. Shareholders of record can vote their shares via the Internet, by using a toll-free telephone number or by completing a proxy card and mailing it in the return envelope provided. If you hold shares through your broker or other intermediary, that person or institution will provide you with instructions on how to vote your shares.

If you are a beneficial holder of our shares, we urge you to give voting instructions to your broker so that your vote can be counted. This is especially important since the New York Stock Exchange does not allow brokers to cast votes with respect to the election of directors or the advisory vote on executive compensation unless they have received instructions from the beneficial owner of shares.

We appreciate your continued support, and we hope that you and yours stay safe and healthy. We are closely monitoring developments with the COVID-19 pandemic and taking proactive measures to ensure business continuity. As part of our existing business continuity protocol, we created a pandemic steering committee that meets daily and regularly communicates new information or guidance to employees and customers. As the situation evolves, we will continue to act to support our customers and the health and well-being of our employees and other stakeholders.

Sincerely, |

|

William Crager |

Chief Executive Officer |

NOTICE OF ANNUAL MEETING

April 8, 2020

Chicago, Illinois

TO THE SHAREHOLDERS OF ENVESTNET, INC.:

The 2020 Annual Meeting of Shareholders of Envestnet, Inc. will be held on May 13, 2020, at 10:00 a.m. Central Time. This year’s Annual Meeting will be a virtual-only meeting via live webcast on the Internet. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting https://web.lumiagm.com/241143720.

The Annual Meeting will be held for the following purposes:

1. | To elect one Class III director to hold office until the 2022 annual meeting and three Class II directors to hold office until the 2023 annual meeting or, in each case, until his successor is duly elected and qualified or until his earlier resignation, removal, death or incapacity; |

2. | To approve, on an advisory basis, 2019 executive compensation; |

3. | To ratify the appointment of KPMG LLP as Envestnet’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

4. | To transact such other business, if any, as lawfully may be brought before the meeting. |

Only shareholders of record at the close of business on March 16, 2020, are entitled to notice of, and to vote at, the virtual Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 13, 2020: THIS PROXY STATEMENT, FORM OF PROXY CARD AND OUR 2019 ANNUAL REPORT ARE AVAILABLE AT WWW.ENVESTNET.COM.

Whether or not you plan to attend the virtual Annual Meeting and regardless of the number of shares you own, please vote as promptly as possible via the internet or by telephone in accordance with the instructions in your proxy materials. If you later desire to revoke your proxy for any reason, you may do so in the manner described in the attached proxy statement. For further information concerning the individuals nominated as directors, the proposals being voted upon, use of the proxy and other related matters, you are urged to read the attached proxy statement.

By Order of the Board of Directors, |

|

Shelly O’Brien |

Corporate Secretary |

TABLE OF CONTENTS

ENVESTNET, INC.

35 East Wacker Drive

Suite 2400

Chicago, Illinois 60601

April 8, 2020

PROXY STATEMENT

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

References to the “Company,” “Envestnet,” “we,” “us,” or “our” in this proxy statement refer to Envestnet, Inc. and its subsidiaries.

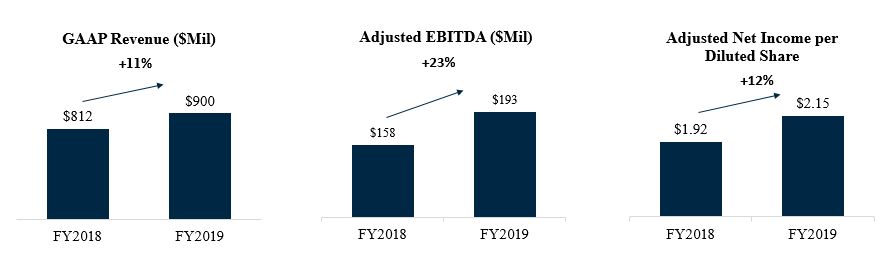

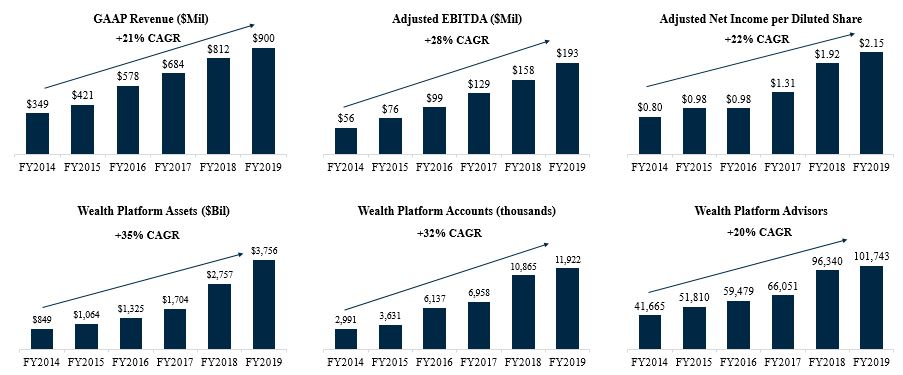

Company Overview

Envestnet is a leading provider of intelligent systems for wealth management and financial wellness. Envestnet’s unified technology enhances advisor productivity and strengthens the wealth management process. Envestnet empowers enterprises and advisors to more fully understand their clients and deliver better outcomes.

Founded in 1999, Envestnet has been a leader in helping transform wealth management, working towards its goal of building a holistic financial wellness network that supports enterprises, advisors and their clients.

Through a combination of platform enhancements, partnerships and acquisitions, Envestnet uniquely provides a financial network connecting software, services, and data, delivering better intelligence and enabling its customers to drive better outcomes.

Leadership Changes

Following the loss of our former Chairman and Chief Executive Officer and dear friend Judson Bergman (the “former

CEO”), our Board of Directors (the “Board”) appointed William Crager as interim Chief Executive Officer (the “interim CEO”)

and Ross Chapin, our lead independent director since 2015, as the interim Chairman of Envestnet’s Board of Directors (the “interim Chairman”). Effective March 30, 2020, the Board appointed Mr. Crager as Chief Executive Officer and as a member of the Board of Directors. Mr. Crager also continues as Chief Executive, Envestnet Wealth Solutions. Also effective March 30, 2020, the Board appointed Stuart DePina, Chief Executive, Envestnet Data & Analytics, as President of Envestnet. In addition, effective March 30, 2020, the Board appointed James Fox as Chairman of the Board and Charles Roame as Vice Chairman of the Board. With the appointment of Mr. Fox as a non-executive Chairman of the Board, Mr. Chapin no longer serves as lead independent director. References in this proxy statement to actions or responsibilities of the “CEO” refer to actions or responsibilities that were performed by the former CEO up until October 3, 2019 and that, beginning October 3, 2019, are currently being performed by Mr. Crager.

Annual Meeting Information

Date: | May 13, 2020 | |

Time: | 10:00 a.m., Central Time | |

Live Webcast Address: | https://web.lumiagm.com/241143720 | |

Record Date: | March 16, 2020 | |

This year’s Annual Meeting will be a virtual-only meeting via live webcast. You will not be able to attend the Annual Meeting in person.

1

Proposals and Board Recommendations

Proposals: | Board recommendation: | For more information, see page: |

1. Election of one Class III director and three Class II directors | “FOR” each director nominee | 17 |

2. Approval, on an advisory basis, of executive compensation | “FOR” | 45 |

3. Ratification of independent registered public accounting firm | “FOR” | 47 |

Our Board of Directors

Board Committees: | ||||||||

Director | Age | Director Since | Independent | Audit | Compensation | Nominating and Governance | Compliance and Information Security Committee | Strategy |

Luis Aguilar* | 66 | 2016 | Y | ü | ü | |||

Anil Arora | 59 | 2015 | N | |||||

Ross Chapin* | 67 | 2001 | Y | ü | ü | ü | ||

William Crager* | 56 | 2020 | N | |||||

Gayle Crowell | 69 | 2016 | Y | ü | ü | Chair | ||

James Fox* | 68 | 2015 | Y | ü | Chair | ü | ü | |

Valerie Mosley | 60 | 2018 | Y | ü | ü | |||

Charles Roame | 54 | 2011 | Y | ü | Chair | ü | Chair | |

Gregory Smith | 56 | 2015 | Y | Chair | ü | ü | ü | |

*Director nominees for election at the 2020 Annual Meeting

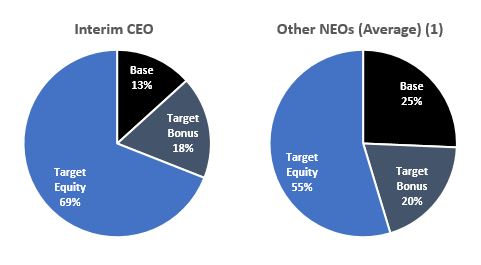

Executive Compensation Highlights

ü | Pay for performance by basing a substantial part of named executive officer (“NEO”) compensation on Company and individual performance, including Performance Share Units |

ü | Conduct annual outreach with investors |

ü | Annual say-on-pay advisory vote |

ü | Strong emphasis on long-term equity compensation; majority of NEOs’ pay is in the form of equity compensation |

ü | Retain an independent compensation consultant |

ü | Maintain a Clawback Policy on incentive awards |

ü | Require stock ownership (as a multiple of base salary) for NEOs |

Board and Corporate Governance Highlights

We are committed to good corporate governance in order to promote the long-term interests of our shareholders, strengthen Board and management accountability, and build public trust in our Company. Our governance framework is described throughout this proxy statement and includes the following highlights:

ü | 7 of 9 independent directors | ü | All Board committees are independent |

ü | Diverse board that provides a range of viewpoints | ü | Stock ownership requirements for directors and NEOs |

ü | Regular board and committee meetings | ü | Regular executive sessions of independent directors |

ü | Annual board and committee self-evaluations | ü | Provide continuing education for directors |

ü | Risk oversight by full Board and committees | ü | Annual review of CEO succession planning |

ü | Directors not “over-boarded” | ü | Code of Ethics and Conduct applicable to all directors, officers and employees |

ü | Director resignation policy if a majority of votes are “withheld” from a director in an uncontested election | ||

Corporate Social Responsibility Highlights

Envestnet is committed to integrating sustainability into our everyday actions to help create long-term value for our shareholders and the communities in which we operate. We aim to operate the Company responsibly while managing risks and using our resources wisely. These principles are grounded in a single ultimate aspiration that guides us and inspires us to move forward: making financial wellness a reality for everyone, and building a company that strengthens the communities we serve for generations to come.

2

In 2019, the Company endeavored to fulfill our commitment to Corporate Social Responsibility in many ways, including:

Focus Area | What We Believe | What We Do |

Community | Envestnet is committed to strengthening our communities through empowering employees to make a positive impact in their communities, as well as through developing financial literacy and an understanding of the financial services industry. | • Envestnet Cares - our employee charitable initiative. • Educational programs including: – Envestnet Institute in Classrooms – Envestnet Institute on Campus – Envestnet | MoneyGuide University Program |

Environment | Envestnet believes in being responsible citizens, as well as enabling access to sustainable investment products. | • Our platform offers access to sustainable products and services through Impact Investing Solutions. • Reduce our impact through targeted initiatives. |

Employees | Envestnet employees are valued members of our Company. We know our team works hard, and that is why we invest in them. | • Offer a comprehensive suite of benefits designed to ensure our employees are taken care of both professionally and personally. • Promote diversity and inclusion and commit to protecting human rights through policies in our Code of Conduct. • Women’s Initiative Network created in 2019. |

Data & Privacy | Envestnet has a responsibility to employ leading risk management and security measures for the handling of sensitive personal financial data. | • Protecting the personal information of those who use our services is a top priority for Envestnet. • Envestnet adheres to leading industry practices for data security, regulatory compliance, and privacy. |

Envestnet has exemplified its commitment in 2019 by practicing sustainability, advocating volunteerism and philanthropy and actively partnering with our employees, customers and partners on environmental, social and governance initiatives.

Additional information on our Corporate Social Responsibility practices is available on our website located at www.envestnet.com/CSR. Information contained on the website is not incorporated by reference into this proxy statement or any other report we file with the SEC.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Why has this proxy statement been made available?

Our Board is soliciting proxies for use at our Annual Meeting of Shareholders to be held on May 13, 2020, and any adjournments or postponements of the meeting. The meeting will be held at 10:00 a.m. Central Time and will be a virtual meeting via live webcast on the Internet. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting https://web.lumiagm.com/241143720. The meeting password is envestnet2020 (case sensitive).

This proxy statement and the accompanying form of proxy are being mailed to shareholders on or about April 8, 2020. This proxy statement provides the information you need to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares.

What proposals will be voted on at the Annual Meeting?

The following proposals are scheduled to be voted on at the Annual Meeting:

• | Election of one Class III director and three Class II directors. |

• | Approval, on an advisory basis, of 2019 executive compensation. |

• | Ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |

Envestnet’s Board recommends that you vote your shares “FOR” each of the nominees to the Board, “FOR” approval, on an advisory basis, of executive compensation and “FOR” the ratification of the selection of KPMG LLP as our independent registered public accounting firm for 2020.

Are proxy materials available on the Internet?

Yes. Our proxy statement for the 2020 Annual Meeting, form of proxy card and 2019 Annual Report are available at www.envestnet.com.

Who is entitled to vote?

Owners of our common stock at the close of business on March 16, 2020, the record date for the Annual Meeting, are entitled to vote. On that date, we had 53,195,798 shares of our common stock outstanding and entitled to vote. Our common stock is our only outstanding class of stock.

3

How many votes do I have?

You have one vote for each share of our common stock that you owned at the close of business on March 16, 2020.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Many of our shareholders hold their shares through a bank, broker, or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held directly in your own name and those owned beneficially through a bank, broker, or other nominee.

Shareholder of Record

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company,

LLC, you are considered, with respect to those shares, the shareholder of record and these proxy materials are being sent to you

directly. As the shareholder of record, you have the right to grant your voting proxy directly or to vote during the Annual Meeting. You may grant your voting proxy in three ways: by mail using the enclosed proxy card, by telephone or by Internet. For information on how to vote by telephone or Internet, see the heading below “May I vote by telephone or via the Internet?” For information on how to vote during the Annual Meeting, see the heading below “How do I vote during the virtual Annual Meeting?”

Beneficial Owner

If your shares are held by a bank, broker, or other nominee, you are considered the beneficial owner of shares held in “street name,” and our proxy materials are being forwarded to you by your bank, broker, or other nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your bank, broker, or other nominee on how to vote your shares and are also invited to attend the virtual Annual Meeting. However, because you are not the shareholder of record you may only vote your shares during the Annual Meeting if your bank, broker or other nominee has provided a signed legal proxy giving you the right to vote those shares and you follow the other instructions described below under the heading “How do I vote during the virtual Annual Meeting?” If your shares are held in street name and you would like to vote by telephone or by Internet, you will need to contact your bank, broker, or other nominee for instructions.

How do I vote by proxy if I am a shareholder of record?

If you are a shareholder of record, you must properly submit your proxy card (by telephone, via the Internet or by mail) so that it is received by us before the Annual Meeting. The individuals named on your proxy card will vote your shares as you have directed. If you sign the proxy card (including electronic signatures in the case of Internet or telephonic voting) but do not make specific choices, your shares will be voted as recommended by the Board:

• | “FOR” the election of each director nominee; |

• | “FOR” the approval, on an advisory basis, of executive compensation; and |

• | “FOR” the ratification of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |

If any other matter is presented at the Annual Meeting, your proxy will be voted in accordance with the best judgment of the individuals named on the proxy card. As of the date of this proxy statement, we know of no other matters to be acted on at the Annual Meeting.

How do I give voting instructions if I am a beneficial owner?

If you are a beneficial owner of shares, you will receive instructions from your bank, broker, or other nominee as to how to vote your shares. If you give instructions to your bank, broker, or other nominee, the bank, broker, or other nominee will vote your shares as you direct. If your broker does not receive instructions from you about how your shares are to be voted, one of two things can happen, depending on the type of proposal. Pursuant to rules of the New York Stock Exchange (the “NYSE”), brokers have discretionary power to vote your shares with respect to “routine” matters, but they do not have discretionary power to vote your shares with respect to “non‑routine” matters. The election of directors and advisory approval of executive compensation are considered “non‑routine” matters and, as such, brokers holding shares beneficially owned by their clients do not have the ability to cast votes with respect to those matters unless the broker has received instructions from the beneficial owner of the shares.

It is therefore important that you provide instructions to your broker if your shares are beneficially held by a broker so that your vote with respect to election of directors and the advisory vote to approve executive compensation, and any other matters treated as non‑routine by the NYSE, is counted.

May I vote by telephone or via the Internet?

Yes. If you are a shareholder of record, you have a choice of voting by telephone using a toll‑free telephone number, voting over the Internet, or voting by completing the enclosed proxy card and mailing it in the return envelope provided. To vote by telephone or via the Internet, follow the instructions provided on the proxy card. We encourage you to vote by telephone or

4

over the Internet because your vote will be tabulated faster than if you mailed it. If you vote by telephone or Internet, you may incur costs, such as usage charges from Internet access providers and telephone companies. You will be responsible for those costs.

If you are a beneficial owner and hold your shares in “street name”, you will need to contact your bank, broker, or other nominee to determine whether you will be able to vote by telephone or electronically through the Internet.

Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote. Voting by telephone or over the Internet or returning your proxy card by mail will not affect your right to attend the virtual Annual Meeting and vote.

May I revoke my proxy or my voting instructions?

Yes. If you change your mind after you vote, if you are a shareholder of record, you may revoke your proxy by following any of the procedures described below. To revoke your proxy:

• | Send in another signed proxy with a later date or resubmit your vote by telephone or the Internet; |

• | Send a letter revoking your proxy to Envestnet’s Corporate Secretary at 35 East Wacker Drive, Suite 2400, Chicago, Illinois, 60601; or |

• | Attend the virtual Annual Meeting and vote during the meeting at https://web.lumiagm.com/241143720. |

If you are a beneficial owner and hold your shares in “street name,” you will need to contact your bank, broker, or other nominee to determine how to revoke your voting instructions.

If you wish to revoke your proxy or voting instructions, you must do so in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the vote is taken.

How do I vote during the virtual Annual Meeting?

You may attend the Annual Meeting and vote your shares at https://web.lumiagm.com/241143720 during the meeting. Follow the instructions provided to vote.

If you are a shareholder of record, you will need the 11-digit control number found on your proxy card and the meeting password envestnet2020 (case sensitive).

If you are a beneficial owner and hold your shares in “street name,” you must first obtain a valid legal proxy from your bank, broker, or other nominee and then register in advance to attend the Annual Meeting. Follow the instructions from your bank, broker, or other nominee included with these proxy materials, or contact your bank, broker, or other nominee to request a legal proxy form. After obtaining a valid legal proxy from your bank, broker, or other nominee, to then register to attend the Annual Meeting, you must submit proof of your legal proxy reflecting the number of your shares along with your name and email address to American Stock Transfer & Trust Company, LLC (“AST”). Requests for registration should be directed to proxy@astfinancial.com or to facsimile number 718-765-8730. Written requests can be mailed to:

American Stock Transfer & Trust Company LLC

Attn: Proxy Tabulation Department

6201 15th Avenue

Brooklyn, NY 11219

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on Tuesday, May 5, 2020.

Even if you plan to attend the virtual Annual Meeting, Envestnet recommends that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

Why are we holding the Annual Meeting virtually?

Our Board annually considers the appropriate format of our annual meeting of shareholders. As part of our effort to maintain a safe and healthy environment for our directors, members of management and shareholders who wish to attend the Annual Meeting, and in light of the COVID-19 pandemic, our Board believes that hosting a virtual Annual Meeting this year is in our best interest and the best interests of our shareholders.

How can I ask questions at the virtual Annual Meeting?

In order to submit a question at the virtual Annual Meeting, you will need your 11-digit control number and the meeting password envestnet2020 (case sensitive). If you are a shareholder of record, the control number can be found on your proxy card. If you are a beneficial owner and hold your shares in “street name,” you can obtain a control number from AST after you register to attend the Annual Meeting as described above under the heading “How do I vote during the virtual Annual Meeting?” You may

5

log in 15 minutes before the start of the Annual Meeting and submit questions online. You will also be able to submit questions during the Annual Meeting.

What do I do if I have technical problems during the virtual Annual Meeting?

If you encounter any difficulties accessing the virtual Annual Meeting webcast, please call toll free (800) 937-5449 or email help@astfinancial.com.

Could emerging developments regarding the COVID-19 pandemic affect our ability to hold the Annual Meeting as planned?

We are closely monitoring developments with the COVID-19 pandemic. As of the date of this proxy statement, we plan to hold a virtual Annual Meeting as disclosed in this proxy statement. If we decide to change the location, date or time of the Annual Meeting, we will issue a press release announcing the change and will file the press release with the U.S. Securities and Exchange Commission (“SEC”) promptly after a decision is made and as soon as practicable prior to the meeting.

What votes need to be present to hold the Annual Meeting?

To have a quorum for our Annual Meeting, the holders of a majority of our shares of common stock outstanding as of March 16, 2020 must be present in person or represented by proxy at the Annual Meeting. The electronic presence of a shareholder at the virtual Annual Meeting will be counted as a shareholder present in person for purposes of determining a quorum.

What vote is required to approve each proposal?

Directors are elected by a plurality vote, which means that the nominees receiving the most affirmative votes will be elected, up to the number of directors to be chosen at the meeting. However, if the majority of the votes cast for a director are withheld, then, notwithstanding the valid election of such director, our by‑laws provide that such director will voluntarily tender his or her resignation for consideration by our Board. Our Board will determine whether to accept the resignation of such director. All other matters submitted for shareholder approval require the affirmative vote of the majority of shares present in person electronically or represented by proxy and entitled to vote.

How are votes counted?

In the election of Envestnet directors, your vote may be cast “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. Your vote may be cast “FOR” or “AGAINST” or you may “ABSTAIN” with respect to the proposals relating to the advisory vote to approve executive compensation and the ratification of Envestnet’s independent registered public accounting firm.

If you sign (including electronic signatures in the case of Internet or telephonic voting) your proxy card with no further instructions, your shares will be voted in accordance with the recommendations of the Board. If you sign (including electronic signatures in the case of Internet or telephonic voting) your broker voting instruction card with no further instructions, your shares will be voted in the broker’s discretion with respect to routine matters but will not be voted with respect to non‑routine matters. As described under the header “How do I give voting instructions if I am a beneficial holder?” the election of directors and the advisory vote to approve executive compensation are considered non‑routine matters.

We will appoint one or more inspectors of election to count votes cast in person electronically or by proxy.

What is the effect of broker non‑votes and abstentions?

A broker “non‑vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner as to how to vote.

Common stock owned by shareholders electing to abstain from voting with respect to any proposal will be counted towards the presence of a quorum. Common stock that is beneficially owned and is voted by the beneficial holder through a broker or bank will be counted towards the presence of a quorum, even if there are broker non‑votes with respect to some proposals, as long as the broker votes on at least one proposal. Broker “non‑votes” will not be considered present and voting with respect to elections of directors or other matters to be voted upon at the Annual Meeting. Therefore, broker “non‑votes” will have no direct effect on the outcome of any of the proposals. Abstentions will be considered present and voting and will have the effect of a vote against a proposal.

Who will pay the costs of soliciting proxies for the Annual Meeting?

Envestnet will pay all the costs of soliciting proxies for the Annual Meeting. Our directors and employees may also solicit proxies by telephone, by fax or other electronic means of communication, or in person. We will reimburse banks, brokers, and other nominees for the expenses they incur in forwarding the proxy materials to you.

6

Where can I find the voting results?

We will report the voting results in a Form 8‑K that we will file with the SEC within four business days after the Annual Meeting. You can find the Form 8‑K at www.sec.gov or on our website at www.envestnet.com.

Will Envestnet’s independent registered public accounting firm attend the Annual Meeting?

Representatives of KPMG LLP (“KPMG”) will attend the virtual Annual Meeting and will have the opportunity to make a statement if they wish and will be available to respond to appropriate questions from shareholders.

Do directors attend the Annual Meeting?

Directors are encouraged to attend all meetings of shareholders called by Envestnet. All of our directors, who were members of our Board at the time, attended the 2019 Annual Meeting.

How can a shareholder, employee, or other interested party communicate directly with our Board?

Our Board provides a process for shareholders, employees or other interested parties to send communications to our Board. Shareholders, employees or other interested parties wanting to contact the Board, the independent directors, the Chairman of the Board, the chairperson of any Board committee, or any other director may send written communications to the Board by email at corpsecy@envestnet.com or by mail at c/o Corporate Secretary, 35 East Wacker Drive, Suite 2400, Chicago, Illinois, 60601. Communication with the Board may be anonymous. The Secretary will forward all communications addressed to the Board, to the Chairperson of the Audit Committee or the Chairperson of the Nominating and Governance Committee, who will then determine when it is appropriate to distribute such communications to other members of the Board or to management.

Whom should I call if I have any questions?

If you have any questions about the virtual Annual Meeting or voting, please contact Shelly O’Brien, our Corporate Secretary, at (312) 827‑2800 or at corpsecy@envestnet.com. If you have any questions about your ownership of Envestnet common stock, please contact Investor Relations at (312) 827‑3940 or by email at investor.relations@envestnet.com.

7

CORPORATE GOVERNANCE

Overview

We review annually, internally and with the Board, the provisions of the Sarbanes‑Oxley Act of 2002, the rules of the SEC and the NYSE’s listing standards regarding corporate governance policies and processes, and are in compliance with the rules and listing standards. We have adopted Corporate Governance Guidelines covering issues such as executive sessions of the Board, director qualification standards, including independence, director responsibilities, and Board self‑evaluations. We have also adopted a Code of Business Conduct and Ethics for our employees and directors and charters for each of our Audit, Compensation, Nominating and Governance, Compliance and Information Security and Strategy Committees. A copy of our Corporate Governance Guidelines, our Code of Business Conduct and Ethics and each committee charter, is available on our website located at www.envestnet.com and you can view and print these documents by accessing our website, then clicking on “Investor Relations,” followed by “Corporate Governance.” In addition, you may request copies of the Corporate Governance Guidelines, the Code of Business Conduct and Ethics and the committee charters by contacting our Corporate Secretary via telephone at (312) 827‑2800, facsimile at (312) 621-7091 or e‑mail at corpsecy@envestnet.com. Our website address is provided as an inactive textual reference only; the information provided on or accessible through our website is not part of this proxy statement.

Leadership Changes

Following the unexpected and sudden passing of our former Chairman and CEO Judson Bergman, our Board of Directors implemented Envestnet’s emergency succession plan. Effective October 3, 2019, our Board appointed William Crager as interim CEO and Ross Chapin, our lead independent director since 2015, as the interim Chairman of Envestnet’s Board of Directors.

Effective March 30, 2020, our Board appointed Mr. Crager as Envestnet’s Chief Executive Officer and as a member of

the Board of Directors. The Board’s decision was based on numerous factors, including Mr. Crager’s extensive experience in the financial services industry, including 20 years with Envestnet, his demonstrated leadership and management qualities, his strong relationships with our customers as well as Mr. Crager’s performance as interim CEO since October 2019. Mr. Crager also continues as Chief Executive, Envestnet Wealth Solutions.

In addition, effective March 30, 2020, the Board appointed Stuart DePina, Chief Executive, Envestnet Data & Analytics, as President of Envestnet. Also effective March 30, 2020, the Board appointed James Fox as Chairman of the Board and Charles Roame as Vice Chairman of the Board. With the appointment of Mr. Fox as a non-executive Chairman of the Board, Mr. Chapin no longer serves as lead independent director.

Corporate Governance Highlights

Our independent directors meet at regularly scheduled executive sessions without the participation of management. James Fox, our Chairman, is the presiding director for executive sessions of independent directors.

Seven of our nine directors are independent. Mr. Crager is not considered an independent director because he is our CEO. Mr. Arora is not considered an independent director because he was an executive officer of the Company within the last three years.

Only independent directors may serve on the Audit and Compensation Committees. In addition, a majority of the directors that serve on the Nominating and Governance, Compliance and Information Security, and Strategy Committees must be independent. Currently, each committee of our Board is composed entirely of independent directors.

Our Audit Committee hires, determines the compensation of, and decides the scope of services performed by our independent registered public accounting firm. In addition, no member of our Audit Committee currently serves on the audit committees of more than two public companies (including Envestnet). Our Audit Committee charter provides that if a member of the Audit Committee simultaneously serves on the audit committees of more than three public companies, the Board will determine if such simultaneous service would impair the ability of such member to effectively serve on the Audit Committee.

Our Compensation Committee evaluates the performance of the CEO based on corporate goals and objectives and, with the other independent directors, sets the CEO’s compensation. The Compensation Committee also has responsibility for evaluating the performance of our senior management and determining executive compensation.

The Compensation Committee works with the Nominating and Governance Committee and the CEO on succession planning.

The Board and each committee of the Board performs an annual self‑evaluation.

8

We have adopted a Code of Business Conduct and Ethics applicable to all directors, officers, and employees that sets forth basic principles to guide their day‑to‑day activities. The Code of Business Conduct and Ethics addresses, among other things, conflicts of interest, corporate opportunities, confidentiality, fair dealing, protection and proper use of company assets, compliance with laws and regulations, including insider trading laws, and reporting illegal or unethical behavior.

Envestnet holds regular Board meetings that last approximately two days each. In addition, our Board holds an annual business review meeting to assess specific areas of our operations and to learn about general trends affecting the wealth management industry. We also provide our directors with the opportunity to attend continuing education programs.

The Board of Directors

Our Board oversees our business and monitors the performance of management. The directors keep themselves up‑to‑date on the Company by discussing matters with the CEO, other key executives and our principal external advisors, such as outside legal counsel, outside auditors, investment bankers, and other consultants, by reading the reports and other materials that we send them regularly and by participating in Board and committee meetings.

The Board usually meets seven times per year in regularly scheduled meetings, but will meet more often if necessary. From time to time, the Board has telephonic sessions on various topics. The Board met nineteen times, including these telephonic sessions, during 2019. All of our directors attended at least 75% of the aggregate number of meetings of the Board and committees of the Board of which they were a member held while they were in office during the year ended December 31, 2019.

Director Independence

In February 2020, our Board determined that the following directors are independent under the listing standards of the NYSE: Luis Aguilar, Ross Chapin, Gayle Crowell, James Fox, Valerie Mosley, Charles Roame, and Gregory Smith. In making its determination of independence, the Board applied the categorical standards for director independence set forth in the NYSE’s rules and therefore determined that no other material relationships existed between us and these directors. The Board also considered the other directorships held by the independent directors and determined that none of these directorships constituted a material relationship with us.

In addition, our Board determined that Mr. Smith, Mr. Chapin, Mr. Fox, and Mr. Roame, the members of our Audit Committee, satisfy the audit committee independence requirements of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and that Mr. Fox, Mr. Chapin, Ms. Crowell and Mr. Smith, the members of our Compensation Committee, satisfy the additional independence requirements for members of the compensation committee under the NYSE listing standards.

9

The Committees of the Board

Our Board has five standing committees: an Audit Committee, a Compensation Committee, a Compliance and Information Security Committee, a Nominating and Governance Committee, and a Strategy Committee.

The Audit Committee

The Audit Committee provides oversight of the integrity of our financial statements and financial reporting process, the system of internal controls, the audit process, the performance of our internal audit program, and the performance, qualification, and independence of the independent registered public accounting firm KPMG.

The Audit Committee is composed entirely of independent directors, as defined by the NYSE listing standards, who also satisfy the requirements of Rule 10A-3 under the Exchange Act.

The members of the Audit Committee are currently Mr. Smith (Chairperson), Mr. Chapin, Mr. Fox, and Mr. Roame.

The Board has determined that each member of the Audit Committee satisfies the financial literacy requirements of the NYSE and that each is an audit committee financial expert, as that term is defined under SEC rules. For additional information about the qualifications of the Audit Committee members, see their respective biographies set forth in “Proposal No. 1: Election of Directors”.

The Audit Committee held eight meetings during 2019. Audit Committee meetings are usually held in conjunction with the regularly scheduled meetings of the Board. At least quarterly, the Audit Committee met with management, KPMG, the Chief Financial Officer, the Chief Accounting Officer and the General Counsel to review, among other matters, the overall scope and plans for the independent audit, and the results of such audit; critical accounting estimates and policies; compliance with our conflict of interest and Code of Business Conduct and Ethics policies.

At least quarterly in 2019, the Audit Committee met in executive session (i.e., without management present) with representatives of KPMG to discuss the results of KPMG’s work.

The Compensation Committee

The Compensation Committee has responsibility for evaluating the performance of the CEO and senior management and determining executive compensation in conjunction with the independent directors. The Compensation Committee also works with the Nominating and Governance Committee and the CEO on succession planning.

The Compensation Committee is composed entirely of independent directors, as defined by the NYSE listing standards, who also satisfy the additional independence requirements specific to compensation committee members set forth in the NYSE listing standards.

The members of the Compensation Committee are currently Mr. Fox (Chairperson), Mr. Chapin, Ms. Crowell, and Mr. Smith.

The Compensation Committee held seven meetings during 2019.

The Compliance and Information Security Committee

The Compliance and Information Security Committee provides oversight of, and reviews, assesses and makes recommendations to our Board regarding, our regulatory compliance programs and information technology security framework.

The Compliance and Information Security Committee is composed entirely of independent directors, as defined by the NYSE listing standards.

The members of the Compliance and Information Security Committee are Ms. Crowell (Chairperson), Mr. Aguilar, Ms. Mosley and Mr. Roame.

The Compliance and Information Security Committee held four meetings during 2019.

The Nominating and Governance Committee

The responsibilities of the Nominating and Governance Committee include identifying individuals qualified to become Board members, recommending director nominees to the Board, and developing and recommending corporate governance guidelines. The Nominating and Governance Committee also has the responsibility to review and make recommendations to the full Board regarding director compensation. In addition to general corporate governance matters, the Nominating and Governance Committee assists the Board and its committees in their self‑evaluations. The Nominating and Governance Committee also works with the Compensation Committee and the CEO on succession planning.

The Nominating and Governance Committee is composed entirely of independent directors, as defined by the NYSE listing standards.

10

The members of the Nominating and Governance Committee are Mr. Roame (Chairperson), Mr. Aguilar, Ms. Crowell, Mr. Fox, Ms. Mosley and Mr. Smith.

The Nominating and Governance Committee held four meetings during 2019.

The Strategy Committee

From time to time prior to December 2019, the Board had utilized an ad hoc strategy committee to provide oversight of the Company’s overall business strategy and strategic initiatives. In December 2019, the Board made the Strategy Committee a standing committee of the Board. The Strategy Committee reviews and provides guidance to the management team and the Board with respect to the Company’s overall business strategy and strategic initiatives. The Strategy Committee’s responsibilities include review with, and recommendations to, management and the Board regarding the development, adoption, modification, and implementation of the Company’s strategic plan. The Strategy Committee also has the responsibility to review and make recommendations to the Board regarding specific strategic initiatives, including acquisitions, divestitures, joint ventures, and strategic alliances. The Strategy Committee is composed entirely of independent directors, as defined by the NYSE listing standards.

The members of the Strategy Committee are Mr. Roame (Chairperson), Mr. Chapin, Mr. Fox and Mr. Smith.

Restrictions on Short-term Speculative Transactions, Hedging and Pledging

Short-Term Speculative Transactions and Hedging

We consider it improper and inappropriate for directors, officers, employees, consultants and temporary contract workers (whom we refer to as “covered persons”) to engage in short-term or speculative transactions in our securities. Consequently, we have adopted a policy that prohibits covered persons from engaging in short sales of our securities (sales of securities that are not then owned), including “sales against the box” (sales with delayed delivery) and in transactions in publicly traded options on our securities (such as puts, calls and other derivative securities) on an exchange or in any other organized market. We also only allow “standing orders” for a brief period of time.

Furthermore, we believe that certain forms of hedging or monetization transactions, such as zero-cost collars and forward sale contracts, may result in a misalignment of our interests and the interests of covered persons. Accordingly, we have adopted a policy that prohibits hedging transactions and all other similar forms of monetization transactions. For purposes of this policy, hedging includes the purchase of financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or engaging in any other transaction, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our securities.

Margin Accounts and Pledging

Envestnet’s current policy permits covered persons to hold our securities in margin accounts and pledge our securities in limited circumstances to strike an appropriate balance between the ability of covered persons to manage their financial affairs with the potential adverse impact to shareholders and the Company that could result from the pledging of a significant number of Company securities by covered persons. Covered persons are prohibited from holding our securities in a margin account or pledging our securities as collateral for a loan unless the covered person clearly demonstrates the ability the repay any obligations arising under the margin account or any loan without resorting to the securities held in the margin account or pledged securities in the case of a loan. We believe that a complete ban on pledging could discourage our executive officers, directors and other covered persons from owning significant levels of Envestnet securities, which we believe would negatively affect shareholders.

Envestnet securities may constitute a significant portion of our officers’s and directors’s personal assets. As a result, situations may arise in which using Envestnet securities as collateral for his or her financial obligations or holding Envestnet securities in a margin account is an attractive means to obtain liquidity rather than achieving it through decreased security ownership. Absent the ability to pledge Envestnet securities in this manner, an officer or director may be forced to sell shares, which is not in our shareholders’ best interests. An absolute prohibition on pledging could create a disincentive for our officers and directors to hold substantial amounts of Envestnet securities for long periods. Although securities held in a margin account or pledged as collateral for a loan may be sold by the broker if a covered person fails to meet a margin call or by the lender in foreclosure if the covered person defaults on the loan, we believe that our policy’s requirement that the covered person demonstrate the ability to repay any obligations arising under the margin account or any loan both effectively mitigates the risk that forced sales of pledged shares could prompt a broader sell-off or further depress a declining stock price and provides our officers and directors with reasonable flexibility to use their Envestnet securities as collateral for loans for needed liquidity and encourages them to retain substantial ownership of our securities.

11

Board Leadership Structure

The Nominating and Governance Committee of our Board evaluates the Board’s leadership structure on a regular basis.

The Company’s By-laws and the Corporate Governance Guidelines do not require the separation of the positions of the Chairman and the CEO. The Corporate Governance Guidelines permit the Board to determine the most appropriate leadership structure for the Company at any given time and give the Board the ability to choose a Chairman that it deems best for the Company.

Historically, the Board believed the combined role of CEO and Chairman under Mr. Bergman was the appropriate leadership structure for the Company. Combining the CEO and Chairman roles under Mr. Bergman provided efficient and effective decision-making and unified leadership for the Company, with a single person setting the tone for management of the Company. Mr. Bergman was well-suited to serve in the Chairman role because his familiarity with the Company’s business enabled him to effectively lead the Board in its discussion, consideration, and execution of the Company’s strategy. The Board also felt that the combined roles of Chairman and CEO were appropriately balanced by the designation of a lead independent director, Mr. Chapin. Mr. Chapin’s responsibilities as lead independent director included, among other things, presiding over all executive sessions of the non‑employee directors, where non‑employee directors meet outside the presence of the management directors, presiding at all other meetings of the Board at which the Chairman was not present, serving as a liaison between the Chairman and the independent directors and discussing with the Chairman all information sent to the Board, including meeting agendas.

Following Mr. Bergman’s passing, the Board decided to separate the positions of interim CEO and interim Chairman and designated our lead independent director, Ross Chapin, who had served as our lead independent director since 2015, as our interim Chairman. The Board felt that separating the two positions at that time would allow the interim CEO to focus on the transition following Mr. Bergman’s passing while providing for a more engaged Board presence through an interim Chairman. Given the successful transition and effective management of the Company under the interim CEO and interim Chairman, the Board determined that separating the positions of CEO and Chairman at this time is the most appropriate leadership structure for the Company. Effective March 30, 2020, the Board appointed independent director James Fox as Chairman of the Board. The Chairman’s responsibilities include, among other things: presiding over all meetings of the Board and executive sessions of the independent directors; presiding over meetings of stockholders; serving as a liaison between management of the Company and the Board; and discussing with the CEO agendas for Board meetings and information to be provided to the Board. The other responsibilities of the Chairman are determined by the Board from time to time.

The Board’s Oversight of Risk

Envestnet’s policies and procedures relating to risk assessment and risk management are overseen by our Board. The Board takes an enterprise‑wide approach to risk management that is designed to support our business plans at a reasonable level of risk. A fundamental part of risk assessment and risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for our Company. The Board annually approves our business plan, giving consideration to risk management. The involvement of the Board in setting our business strategy is a key part of its assessment of management’s risk tolerance and also its determination of what constitutes an appropriate level of risk for our Company. Each committee of the Board oversees certain risks and the management of such risks. As described further below, however, the entire Board is regularly informed through committee reports and management presentations about such risks.

The Audit Committee of the Board reviews our policies and practices with respect to risk assessment and risk management and discusses with management our major financial risk exposures and the steps that have been taken to monitor and control such exposures.

The Compensation Committee assesses our executive compensation programs to ascertain any potential material risks that may be created by the compensation program.

In conducting this assessment, the Compensation Committee focuses on our incentive compensation programs in order to identify any general areas of risk or potential for unintended consequences that exist in the design of our compensation programs; and to evaluate our incentive plans relative to our enterprise risks to identify potential areas of concern, if any.

The Compensation Committee considered the findings of this assessment of compensation policies and practices and determined that our compensation programs are designed and administered with the appropriate balance of risk and reward in relation to our overall business strategy. The Company’s policies and practices are not structured to encourage executives to take unnecessary or excessive risks, and therefore do not create risks reasonably likely to have a material adverse effect on our Company.

The Nominating and Governance Committee manages risks associated with general corporate governance and succession planning.

The Compliance and Information Security Committee reviews potential risk related to regulatory compliance requirements and reviews and assesses our regulatory compliance programs. The Compliance and Information Security Committee also reviews

12

potential risk related to our information technology systems, including cybersecurity risk, and reviews and assesses our information technology security framework.

Director Self-Evaluations

The Board and each committee of the Board conduct a formal annual self‑evaluation to assess the business skills, experience, and background represented on the Board and to determine whether the Board and its committees are functioning effectively. During the year, the Nominating and Governance Committee receives input on the Board’s performance from directors and discusses the input with the full Board and oversees the self-evaluation process. The self‑evaluation focuses on whether the Board is operating effectively and on areas in which the Board or management believes that the Board or any of its committees could improve. The self-evaluation may be in the form of written or oral questionnaires or interviews and may be conducted by a third party. Each year the Nominating and Governance Committee discusses and considers the appropriate approach and approves the form of the self-evaluation.

The results of the self-evaluation are reviewed by the Nominating and Governance Committee and summarized for the full Board. Any recommendations for improvement are reviewed by the full Board and appropriate plans are initiated by the Board to address such recommendations.

Director Nominations

In accordance with its charter, the Nominating and Governance Committee identifies potential nominees for directors from various sources. When reviewing candidate’s qualifications, the Nominating and Governance Committee considers the relevance of their experience and background as well as their independence, judgment, understanding of our business or other related industries and such other factors as the Nominating and Governance Committee determines are relevant in light of the needs of the Board and our Company. The Nominating and Governance Committee will select qualified candidates and review its recommendations with the Board, which will decide whether to nominate the person for election to the Board. Elections typically occur at our annual meeting but, upon the recommendation of the Nominating and Governance Committee, the Board may approve additions to the Board between annual meetings.

The Board believes that it is important that the Board members represent a diverse mix of viewpoints. The Nominating and Governance Committee works with the Board on an annual basis to determine the appropriate characteristics, skills and experience for the Board as a whole and its individual members in light of the needs of the Board, including the extent to which the current composition of the Board reflects a diverse mix of knowledge, experience, skills and backgrounds. The skills and backgrounds collectively represented on the Board should reflect the diverse nature of the business environment in which the Company operates. In evaluating the suitability of individual Board members, the Board and the Nominating and Governance Committee take into account numerous factors such as the individual’s general understanding of marketing, finance and other disciplines relevant to the success of a publicly traded company; performance as a member of the Board; understanding of the Company’s business; education and professional background, including current employment and other Board memberships; reputation for integrity; gender; race and any other factors they consider to be relevant. The Board evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best advance the success of the Company’s business, and represent shareholder interests through the exercise of sound judgment, using its diversity of experience. Any search firm engaged to assist the Board or the Nominating and Governance Committee in identifying candidates for appointment to the Board is specifically directed to include diverse candidates. In determining whether to recommend a director for re‑election, the Nominating and Governance Committee also considers the director’s past attendance at meetings and participation in and contributions to the activities of the Board.

In connection with its self‑evaluation described above under “Director Self-Evaluations,” the Nominating and Governance Committee assesses whether it effectively nominates candidates for director in accordance with the above described standards specified by the Company’s Corporate Governance Guidelines. See each nominee’s and director’s biography appearing later in this proxy statement for a description of the specific experiences that each such individual brings to our Board.

Shareholder Recommendations and Nominations of Director Candidates

The Nominating and Governance Committee will consider a shareholder’s recommendation for directors by following substantially the same process and applying substantially the same criteria as for candidates recommended by other sources, but the Nominating and Governance Committee has no obligation to recommend such candidates for nomination by the Board. To have a director recommendation evaluated by the Nominating and Governance Committee, a shareholder should provide timely notice of its recommendation with the biographical and background materials set forth in Section 5.2 of our by-laws related to director nominations. Shareholder recommendations for directors should be mailed to: Corporate Secretary, Envestnet, Inc., 35 East Wacker Drive, Suite 2400, Chicago, Illinois, 60601. No person recommended by a shareholder will become a nominee for director and be included in a proxy statement unless the Nominating and Governance Committee recommends, and the Board approves, such person.

13

If a shareholder desires to nominate a person for election as director at a shareholders’ meeting, that shareholder must comply with Section 5.2 of our by‑laws, which requires, among other things, notice not more than 120 days nor less than 90 days in advance of the anniversary of the date of the proxy statement provided in connection with the previous year’s annual meeting of shareholders. For more information, see the section entitled “Shareholder Proposals for 2021 Annual Meeting.”

Related Party Transaction Policy and Procedures

Our Board has adopted a written Related Party transactions policy. This policy applies to any transaction, arrangement or relationship in which we (including any of our subsidiaries) were, are, or will be a participant, the amount involved exceeds $120,000 annually and in which any director, officer, 5% or greater shareholder or certain other related parties or entities (each, a “Related Party”), has a direct or indirect material interest. We refer to these transactions as “Related Party Transactions.” Under the policy, the Audit Committee considers all of the relevant facts and circumstances in determining whether to approve a Related Party Transaction, including:

• | The benefits to us of the proposed Related Party Transaction; |

• | The impact on a director’s independence in the event the Related Party is a director, an immediate family member of a director, or an entity in which a director is a partner, shareholder or executive officer; |

• | The creation of an actual or apparent conflict of interest; |

• | The availability of other sources for comparable products or services; |

• | The terms of the proposed Related Party Transaction; |

• | The Related Party’s interest in the transaction; and |

• | The terms available to unrelated third parties or to employees generally. |

The Audit Committee will approve only those Related Party Transactions that are in, or are not inconsistent with, the best interests of our Company and our shareholders, as the Audit Committee determines in good faith.

The following types of transactions do not require approval or ratification under this policy:

• | Transactions involving the purchase or sale of products or services in the ordinary course of business, not exceeding $120,000; |

• | Transactions in which the Related Party’s interest derives solely from his or her service as a director of another corporation or organization that is a party to the transaction; |

• | Transactions in which the Related Party’s interest derives solely from his or her ownership of less than 10% of the equity interest in another person (other than a general partnership interest) which is a party to the transaction; |

• | Transactions in which the Related Party’s interest derives solely from his or her service as a director, trustee or officer (or similar position) of a not‑for‑profit organization or charity that receives donations from us; |

• | Compensation arrangements of any executive officer (other than an individual who is an immediate family member of a Related Party) that have been approved by the Compensation Committee of our Board and that are reported in our annual meeting proxy statement or would be reported if the executive officer were a named executive officer; and |

• | Director compensation arrangements that have been approved by our Board and that are reported in our annual meeting proxy statement. |

Related Party Transactions

Since January 1, 2019, we have had no Related Party Transactions.

Indemnification of Directors and Executive Officers

We have entered into agreements to indemnify our directors and certain of our officers in addition to the right to indemnification provided to such persons in our certificate of incorporation and by‑laws. These agreements will, among other things, require us to indemnify these individuals to the fullest extent permitted under Delaware law, including for certain expenses (including attorneys’ fees), judgments, fines and settlement amounts incurred by such person in any action or proceeding, including any action by or in our right, on account of services by any such person as a director or officer of our Company or as a director or officer of any of our subsidiaries, or as a director or officer of any other company or enterprise if any such person serves in such capacity at our request. We also intend to enter into indemnification agreements with our future directors and executive officers.

Delinquent Section 16(a) Reports

Our executive officers and directors are subject to the reporting requirements of Section 16 of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. Except as disclosed in the next sentence, we believe that all of our executive officers and directors complied with all filing requirements imposed by Section 16(a) of the Exchange Act on a timely basis during fiscal year 2019. Due to an administrative error, (1) Messrs. Arora, Grinis, Mayer and Thomas and Ms. O’Brien were each late in filing a Form 4 to report our withholding of shares of common stock to satisfy their tax withholding obligations

14

in connection with a vesting of restricted stock units and (2) Mr. Arora was late in filing an additional Form 4 to report the forfeiture of restricted stock units in connection with his stepping down as our Vice Chairman and Chief Executive of Envestnet | Yodlee.

DIRECTOR COMPENSATION

Our non-employee directors receive an annual retainer of $190,000. Directors receive $50,000 of the annual retainer in cash and the remaining $140,000 in restricted stock units. The Chairperson of our Audit Committee receives an additional annual retainer of $25,000. The Chairpersons of our other committees receive an additional annual retainer of $20,000. The former lead independent director received an additional annual retainer of $30,000 for his service as lead independent director in 2019. All non-Chairperson committee members receive an additional annual retainer of $10,000 for each committee on which they serve. Any such additional annual retainer amounts paid to a director for serving on a committee as a Chairperson or as a member are paid 25% in cash and 75% in restricted stock units.

Anil Arora stepped down as Vice Chairman of Envestnet and Chief Executive of Envestnet | Yodlee effective March 1, 2019 and continues to serve as a director on our Board. Mr. Arora became entitled to compensation as a non-employee director beginning April 1, 2020.

Cash amounts paid to directors are paid quarterly with respect to the pro rata portion of fees earned during that quarter. Equity amounts paid to directors are granted once a year no later than March 31st for the amounts earned during the previous year. With respect to equity awards granted in 2019, restricted stock units fully vest on the first anniversary of the grant.

In addition, all directors who join the Board receive an initial equity grant of $100,000 of restricted stock units.

All equity grants to our non‑employee directors are made pursuant to our 2010 Long‑Term Incentive Plan.

We also reimburse all of our directors for their reasonable expenses incurred in attending meetings of our Board or committees.

Stock Ownership Guidelines - Non-employee Directors

To align the interests of the non-employee members of our Board with the long-term interests of our shareholders, all non-employee directors must maintain an ownership level in our common stock equal to or greater than $300,000. Directors have four years to come into compliance with the ownership guidelines.

Director Compensation Table

The following table sets forth the compensation paid to our non-employee directors, except Mr. Arora, in 2019. Mr. Arora was an NEO for 2019 and his 2019 compensation is presented in the summary compensation tables included elsewhere in this proxy statement.

Name | Fees Earned or Paid in Cash ($) | Option Awards ($)(*) | Stock Awards ($)(*) | Total ($) | ||||||||

Luis Aguilar | 58,000 | — | 140,237 | 198,237 | ||||||||

Ross Chapin | 66,920 | — | 167,254 | 234,174 | ||||||||

Gayle Crowell | 63,000 | — | 148,527 | 211,527 | ||||||||

James Fox | 64,420 | — | 156,754 | 221,174 | ||||||||

Valerie Mosley | 57,750 | — | 24,437 | 82,187 | ||||||||

Charles Roame | 64,590 | — | 152,886 | 217,476 | ||||||||

Gregory Smith | 66,545 | — | 163,508 | 230,053 | ||||||||

*Restricted stock unit awards were granted on March 4, 2019 with a fair market value of $61.40. The amounts reported represent the aggregate grant date fair value during the fiscal year, as calculated under the Financial Accounting Standards Board’s Accounting Codification Topic 718 (“ASC 718”). Under ASC 718, the grant date fair value is calculated using the closing market price of our common stock on the date of grant, which is then recognized, subject to market value changes, over the requisite service period of the award.

15

Outstanding Unvested Awards

As of December 31, 2019, the following unvested awards were outstanding for each non-employee director, except Mr. Arora whose outstanding unvested awards are set forth in the 2019 Outstanding Equity Awards at Fiscal Year-End table included elsewhere in this proxy statement:

Luis Aguilar | 146 | options | |

2,417 | restricted stock units | ||

Ross Chapin | 488 | options | |

2,949 | restricted stock units | ||

Gayle Crowell | 146 | options | |

2,552 | restricted stock units | ||

James Fox | 458 | options | |

2,772 | restricted stock units | ||

Valerie Mosley | — | options | |

1,299 | restricted stock units | ||

Gregory Smith | 454 | options | |

2,879 | restricted stock units | ||

Charles Roame | 438 | options | |

2,675 | restricted stock units | ||

16

PROPOSAL NO. 1: ELECTION OF DIRECTORS

General

Our Board is divided into three classes with the terms of office of each class ending in successive years. Our by‑laws provide for a minimum of 5 and a maximum of 11 directors and empower our Board to fix the exact number of directors and appoint persons to fill any vacancies on the Board until the next annual meeting.

Following the recommendation of the Nominating and Governance Committee, our Board has nominated William Crager to serve a two-year term to expire at the annual meeting in 2022 and Luis Aguilar, Ross Chapin, and James Fox to each serve a three-year term to expire at the annual meeting in 2023 or, in each case, until his successor is duly elected and qualified or until his earlier resignation, removal, death or incapacity. Each nominee is currently serving as a director of Envestnet.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NOMINEE AS A DIRECTOR OF ENVESTNET.

If any director nominee is unable to serve, the individuals named as proxy may vote for another nominee proposed by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why any nominee may be unable to serve as a director. If any director resigns, dies, or is otherwise unable to serve out his or her term, or the Board increases the number of directors, the Board may fill the vacancy until the next annual meeting of shareholders.

Set forth below is information with respect to the nominees for election as directors and the other directors whose terms of office as directors will continue after the Annual Meeting. There are no arrangements or understandings between any director and any other person pursuant to which any director was or is selected as a director or nominee.

17

Nominee for election for a term expiring in 2022 (Class III)

William Crager | Mr. Crager, age 56, serves as our Chief Executive Officer. Previously, Mr. Crager served as our Interim Chief Executive Officer between October 2019 and March 2020, Chief Executive of Envestnet Wealth Solutions since January 2019, and President of Envestnet since 2002. Prior to joining us, Mr. Crager served as Managing Director of Marketing and Client Services at Rittenhouse Financial Services, Inc., an investment management firm affiliated with Nuveen Investments. Mr. Crager received an MA from Boston University and a BA from Fairfield University, with a dual major in economics and English. |

Mr. Crager’s qualifications to serve on our Board include his extensive familiarity with the financial services industry acquired through his 20 years with the Company and his prior work experience. | |

18

Nominees for election for a term expiring in 2023 (Class II)

Luis Aguilar | Mr. Aguilar, age 66, has served as a member of our Board since March 2016. Mr. Aguilar was a Commissioner at the U.S. Securities and Exchange Commission from July 2008 through December 2015. Prior to his appointment as an SEC Commissioner, Mr. Aguilar was a partner with the international law firm of McKenna Long & Aldridge, LLP (subsequently merged with Dentons US LLP), specializing in corporate and securities law. Mr. Aguilar’s previous experience includes serving as the general counsel, head of compliance, Executive Vice President and Corporate Secretary of Invesco, Inc. with responsibility for all legal and compliance matters regarding Invesco Institutional. While at Invesco, he was also Managing Director for Latin America and president of one of Invesco’s broker-dealers. His career also includes tenure as a partner at several prominent national law firms: Alston & Bird LLP; Kilpatrick Townsend & Stockton LLP; and Powell Goldstein Frazer & Murphy LLP (subsequently merged with Bryan Cave LLP). He began his legal career as an attorney at the U.S. Securities and Exchange Commission. |

Mr. Aguilar represented the Commission as its liaison to both the North American Securities Administrators Association and to the Council of Securities Regulators of the Americas. He also served as the sponsor of the SEC’s first Investor Advisory Committee. | |

Mr. Aguilar serves as a director of Donnelley Financial Solutions, Inc. He has been a Principal in Falcon Cyber Investments, an investment firm exclusively focused on cyber security investment, since January 2016. | |

Mr. Aguilar is a graduate of the University of Georgia School of Law, and also received a master of laws degree in taxation from Emory University. He had earlier earned an undergraduate degree from Georgia Southern University. | |

Mr. Aguilar’s qualifications to serve on our Board include his experience as an SEC Commissioner and his extensive experience in corporate, securities and compliance matters, especially as they apply to investment advisors, investment companies and broker-dealers. | |

Ross Chapin | Mr. Chapin, age 67, has served as a member of our Board since 2001. In October 2018, Mr. Chapin retired as a Managing Director of Parametric Portfolio Associates LLC, a provider of structured portfolio management, which he joined as a senior executive in October 2005. Prior to Parametric, Mr. Chapin co‑founded Orca Bay Partners, a private equity firm, in 1998. Mr. Chapin received an MBA from Columbia University in finance and accounting, and has an undergraduate degree from Denison University. |